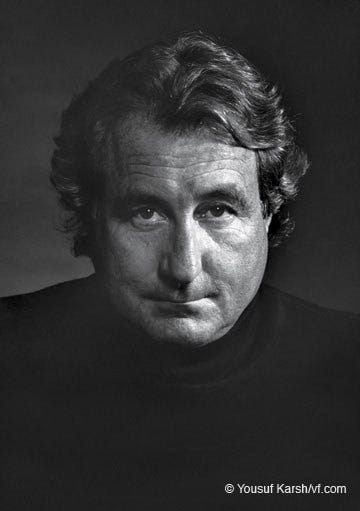

Madoff - Are All Humans Ultimately Greedy?

|

|

Courtesy Top Clockwise

Financial Post, an architectural photo blog, CNBC

|

It’ll

be 11 years this coming December 11th since the Madoff scandal broke,

but with the airing of the latest movie, The Wizard of Lies, starring,

Robert De Niro, and the TV series, Madoff, starring, Richard Dreyfuss,

that financial nightmare seeps back into one’s consciousness, and

questions shock prevented many of us to ask then, come bubbling to the

surface now…

Is there no way man can be prevented to chase greed, no matter how good a man he may be?

Is Bernard Madoff a sociopath?

And, if so, just because evil presents itself in our lives, are we not equally to blame when accepting the Devil’s Pact?

Until

I watched both these productions, I had no idea how simple and utterly

baseline this scam was. I always assumed it was far more complicated to

entrap such savvy investors, but I gather when word got around,

literally globally, that there was a Wall Street trader who could

practically guarantee a monthly average ROI (Return On Investment) of

12%, no matter how the market fluctuated, people, rich and not so,

flocked to him like he was the second coming of Jesus, pardon the

off-Jewish reference.

On

the 19th floor of Manhattan’s Lipstick Building, to have a legitimate

trading company that had been losing money for years — to the ignorance

of even Bernie’s sons who ran the operation — and then have a sham

investment company on the 17th floor where all the workers did was punch

out fake trades and fake returns on 30 year-old computer systems and

dot-matrix printers (the assumption was that if Bernie upgraded, he’d

need to draft new tech guys willing to become criminals and with

advanced systems in place there was a better chance his scam could be

discovered) seems utterly incredible if you place your trust in

government regulators like the SEC — Securities Exchange Commission — so

begs a fourth question:

The

banks and financial institutions that invested with Madoff and the

government whose responsibility it was to protect investors, were they

afraid to offend Madoff by prying too much into the man who was

considered the premier trader of all time or did they choose to look the

other way so the fantasy bubble would not burst?

The

wholly unscientific answer to the above question that springs from my

gut: both. If you’re big and powerful, by default, you’re considered to

do no wrong, or at least too big to fail — think of any bad doctor or

lawyer since the dawn of time and the all-too common human need to never

tip any good cash cow — also, Harvey Weinstein barfs to mind.

|

| Courtesy American Express |

Ponzi

schemes have been around since there’s been money to invest — or rather

since in 1919 when Charles Ponzi set up a postage stamp scam under his

Securities Exchange Company that lasted until August of 1920 — so you

can’t tell me global financiers weren’t aware that such a possibility

could exist with all trading houses and investment firms. People want to

lay all the blame as Bernie’s feet, but, honestly, Bernie is right when

he says that it takes two to tango. The Devil can offer you a deal you

think you can’t refuse but the refusal is ultimately up to you. Buyer Bloody Beware.

I know that’s a cruel thing to say as so many people were so very hurt

by this man — life savings evaporated, people became destitute and some

died from the stress and others committed suicide — so there is no way

to defend Madoff. But it comes back to the question of man’s greed and

man’s trust in his fellow man.

When

do we take responsibility for our own decisions and acknowledge that if

we choose to put all our proverbial chips on the number 7 and the roll

of the dice comes up snake eyes, who’s fault is it? The Devil who

offered the craps game or the gamer who chose to play?

I

don’t ask these questions lightly, for I myself have made some pretty

stupid decisions with money over my lifetime, placing too much trust in

others to handle my funds or investing without enough due diligence.

Heck, even back in the day when Bernie could have lost his shirt on the

then popular penny stocks, my own uncle lost a chunk investing in the

same scam. My saving grace and my uncle’s: not all our eggs were plunked

into one basket, so we survived. Too many investors saw that magical

Madoff ROI and basketed their all.

Madoff

is a Greek Tragedy, a morality tale, a sorrowful ending to a jubilant

promise that the sky’s the limit if only you believe, and you trust. It

didn’t matter that Bernie was seen as a walking, talking money-making

miracle or that he was a three-times Chairman of NASDAQ, the guy at

heart was a back alley con from Queens who got juiced over getting one

over on the next guy. Sound familiar? *cough* Donald Trump *cough*

To answer the question:

Is Bernie Madoff a sociopath?

In

the De Niro film, they leave the answer swinging in the breeze along

with Bernie’s son’s corpse. In the Dreyfuss series, the Madoff character

thinks it’s ludicrous to compare what Bernie did to his victims to what

Ted Bundy did to those girls, but is it ludicrous?

Madoff himself was interviewed recently by the Ponzi Supernova

podcaster and claimed that his prison shrink said he’s in no way a

sociopath.

Listen, I don’t care who says what, when or where, Bernard L. Madoff is a 3D Technicolor sociopath, plain and simple.

In

the DSM IV, Anti-Social Personality Disorder — the clinical term for

sociopathy/psychopathy — has the Criterion A Symptoms as follows;

A) Failure to confirm to social norms with respect to lawful behaviors

B) Deceitfulness as in repeated lying

C) Impulsivity or failure to plan ahead

D) Irritability and aggressiveness

E) Reckless disregard for the safety of self or others

F) Consistent irresponsibility

G) Lack of remorse

And in the DSM-5, ASPD has the Trait Descriptors as follows;

A) Deceitfulness, Dishonesty and fraudulence

B) Manipulativeness

C) Impulsivity

D) Hostility

E) Risk-Taking

F) Irresponsibility

G) Callousness

I’m

no shrink but Bernie checks off on every damn point. He may not have

chosen a crow bar, a knife, a hatchet or a chunk of wood as his weapons

like Ted Bundy did but Madoff serial killed all the same, time after

time, dead victim after dead victim, two being his own sons, one by

suicide and one by cancer, the latter I’m positive resurfaced due to the

incredible stress.

According

to the aforementioned film productions and podcast, Bernie nowadays

lives a stress-free life, playing poker with his jailhouse pals and

buying up all the hot chocolate mix from the prison commissary, so if

you want a cup of the rich brown treat, you have to go to Bernie and his

jacked-up prices. Stiffing clients, then as now, while his sons and his

other victims moulder in their graves and his wife is forever tainted

and scorned, decries a serial killer in my book.

And

as to Ruth Madoff, the only sin I see in this woman is choosing to live

a life free of any worries or responsibilities, playing the ever-happy

socialite, never needing or wanting to ask questions. Ignorance is a

sin, too, and it harms all the same. One wonders how many more

Greenwich, Connecticut, Midtown Manhattan or West Palm Beach socialites

are living that same oblivious dream right this very minute, betting

their lives and their future reputations on the choices their

sociopathic tycoon husbands make. *cough* Melania Trump *cough.* Jeffry

Picower’s wife, Barbara, claims she never knew about the scheme, and in

the federal “claw back” for the scammed profits agreed to return $7.2

billion to help pay back the investors. That only left Barbara with

under $2 billion dollars for fun money. My heart bleeds. You can be sure

that if, “Greed is good,” so says Michael Douglas’s character in Wall

Street, there are many such Bernie and Ruth Madoffs. That thought alone

is terrifying.

|

| Courtesy Katehon |

To the eternal questions of man’s greed:

Can we evolve and overcome this inbred need?

When is enough, enough?

Why is there this the need to accumulate more wealth in those who are already millionaires, billionaires?

How many homes, how many yachts, how many anythings is finally too many?

My

heart tears for Bernie’s little investors who didn’t know any better

and trusted their friend, but as to the rich investors… it’s hard to

feel sorry for people who need a consistent 12% monthly ROI on the

billions they already have, and to these people I can see where Bernie

has little remorse himself.

|

| Bernie with Norm Levy, Ruth & Carl Shapiro, Barbara & Jeffry Picower, Stanley & Pamela Chais, Photos Courtesy l to r: Vanity Fair, Business Insider, The New York Times, twinkletoesengineering |

I’m

primarily referencing Bernie’s Big Four: Norman Levy, Jeffry Picower,

Carl Shapiro and Stanley Chais, the latter demanding to never see a

negative trade from Bernie which more than suggests these guys KNEW

Madoff had formulated a Ponzi scheme and were fine and dandy with it,

knowing their ROI would be a constant flow thanks to the thousands of

smaller, innocent investors under them. Why is my mind’s eye replaying

the tipping over of the money changer tables in Jesus’s Jerusalem?

The

disease of wealth and power in mankind is such a disturbing issue. One

wonders that if we do go extinct, will it be because of this vert trait.

It’s like some people get mired in quicksand on their way up Maslow’s

Pyramid. They forever rev their engines on the Self-Esteem rung where

there’s never enough material recognition, adulation and respect, and

they think getting more of the same will get them summiting the very top

of the contentment ladder when doing so will do anything but.

|

| Courtesy Psychology Today |

Once you materially get what you need, the rest is overflow, flotsam, and a bloody waste.

I

personally think greed boils down to a complete lack of self-esteem.

That no matter how much people admire you for your ability to gain and

give material wealth, you never really admire yourself for yourself, and

so the quest for more is never-ending. I’m afraid you can lump many a

tycoon into this basket, starting with Donald Trump. There was a

political commentator I listened to the other day who said that there has been no love that Trump hasn’t had to buy.

Bloody sad but true. The same can basically be said for Bernie. All the

people who flew to their social get-togethers at Montauk or Palm Beach

were as moths to an abundant flame, and when that flame burned itself

out, those moths took flight, never to be seen nor heard from again.

Maybe

that’s the crux for self-conscious souls like Madoff and Trump. Maybe

they know, deep down inside, that if the material dissolves so will

everyone who ever said they cared. To be an empty vessel no amount of

money can ever fill has got to be Hell on earth, and to that I say to

all of Madoff’s victims…

Be glad you are who you are and thrive with a heart and a soul.

No amount of material loss you suffered will ever be as bad as being Madoff.

Medium.com is plastered every day with articles on how to become more “successful.”

But

before you dive into the next “10 Points to Blah, Blah, Blah…” post,

consider redefining success for yourself, and remember Bernie Madoff and

his pathetic Ponzi scheme.

What

exists now that you can touch today, be it marble and gold, can, in a

blink of an eye, become cardboard and ash, if you allow yourself to be

the next Greek tragedy in the Evil Art of Wanting More.

|

| Courtesy Business Insider — De Niro as Madoff in The Wizard of Lies |

Post Script:

After watching the films the other night, I looked at myself in the mirror, and I asked, Could this kind of greed happen to me? Could I chase greed to the point of causing harm to others? As

De Niro’s face showed a flat effect to the camera when asked the same,

the screen quietly fading to black, I, too, turned out the lights and

fled the mirror without a word.

Comments